Payroll calculator georgia 2023

Secondly FICA and state. To begin with federal income is taxed at 1227 percent while state income is taxed at 462 percent.

2023 Nissan Leaf Ev Incentives Golden State Nissan

Ad Compare This Years Top 5 Free Payroll Software.

. The first thing you need to know about the Georgia paycheck calculator is. Fy 2022 state salary schedule folder name. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Plug in the amount of money youd like to take home. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Georgia annualmonthly salary schedule for 10 months employment base equals school year level of certification salary step t. Free Unbiased Reviews Top Picks. The Salary Calculator is an excellent tool for identifying how your payroll deductions and income taxes are split up with details of how each is calculated and the.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate. Get Started With ADP Payroll.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Get Started With ADP Payroll. Iowa also requires you to pay.

Georgia tax year runs from July 01 the year before to June 30 the current year. Georgia Hourly Paycheck Calculator. Ad Compare This Years Top 5 Free Payroll Software.

Ad Process Payroll Faster Easier With ADP Payroll. Georgia Salary Paycheck Calculator. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and.

Ad Process Payroll Faster Easier With ADP Payroll. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State. So the tax year 2022 will start from July 01 2021 to June 30 2022.

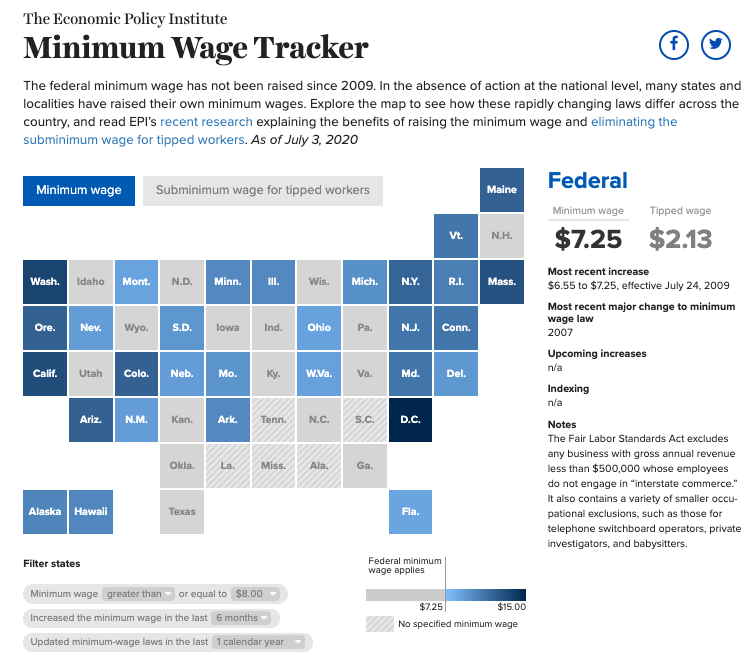

In Iowa the rates for 2022 are between 0 and 75 of the first 34800 of taxable wages depending on the number of employees you have. For 2022 the minimum wage in Georgia is 725 per hour. Free Unbiased Reviews Top Picks.

Employers also have to pay a matching 62 tax up to the wage limit. Calculating your Georgia state. US Tax Calculator and alter the settings to match your tax return in 2022.

Lets go through your gross salary in further depth. Georgia Paycheck Calculator 2022 - 2023. Medicare tax which is 145 of each employees taxable wages up to 200000 for the year.

This 202322k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables. The standard FUTA tax rate is 6 so your max. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

It can also be used to help fill steps 3 and 4 of a W-4 form.

Companies Plan To Give Big Raises In 2023 Amid Inflation Money

Federal Register Medicare Program Fy 2023 Hospice Wage Index And Payment Rate Update And Hospice Quality Reporting Requirements

Federal Register Medicare Program Fy 2023 Hospice Wage Index And Payment Rate Update And Hospice Quality Reporting Requirements

2023 Kia Sportage Suvs For Sale Buford Ga Kia Mall Of Georgia

Federal Register Medicare Program Fy 2023 Hospice Wage Index And Payment Rate Update And Hospice Quality Reporting Requirements

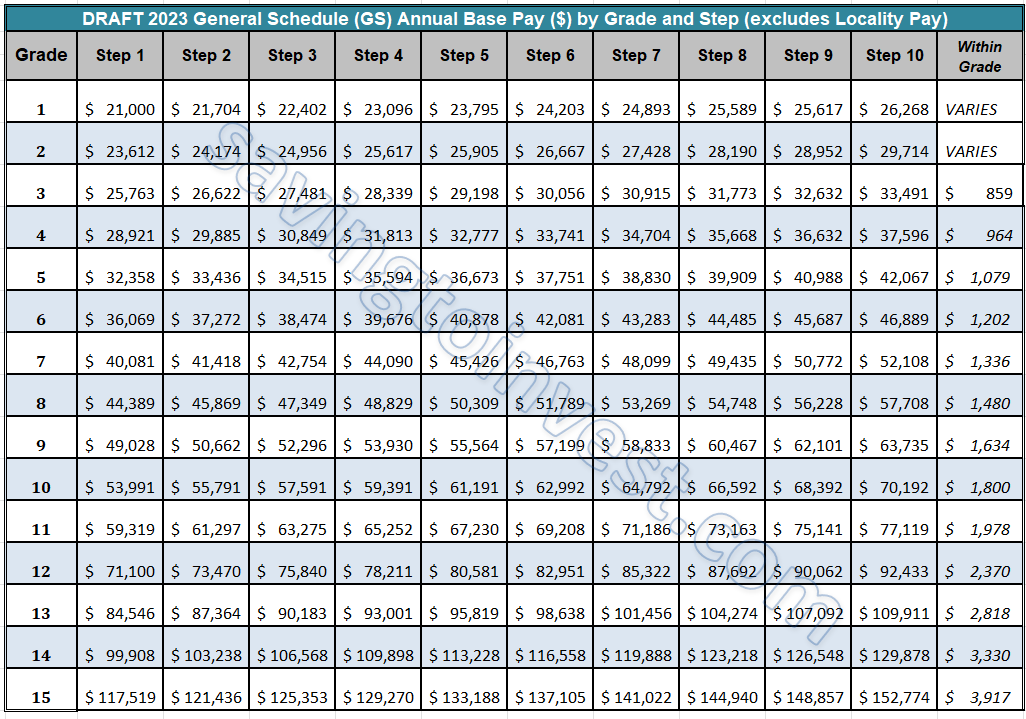

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

Minimum Wage Tracker Economic Policy Institute

2022 2023 Latest Chinese Baby Gender Prediction Calendar Boy Or Girl Youtube In 2022 Baby Gender Prediction Gender Prediction Gender Prediction Calendar

2023 College Football Championship Odds Track Ncaaf Favorites

2023 Nissan Ariya Ev Incentives Golden State Nissan

2023 Federal Pay Raise Update House Committee Endorses 4 6

Federal Register Medicare Program Fy 2023 Hospice Wage Index And Payment Rate Update And Hospice Quality Reporting Requirements

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Sports Roster And Schedule Team Schedule Schedule Template Weekly Schedule Template Excel

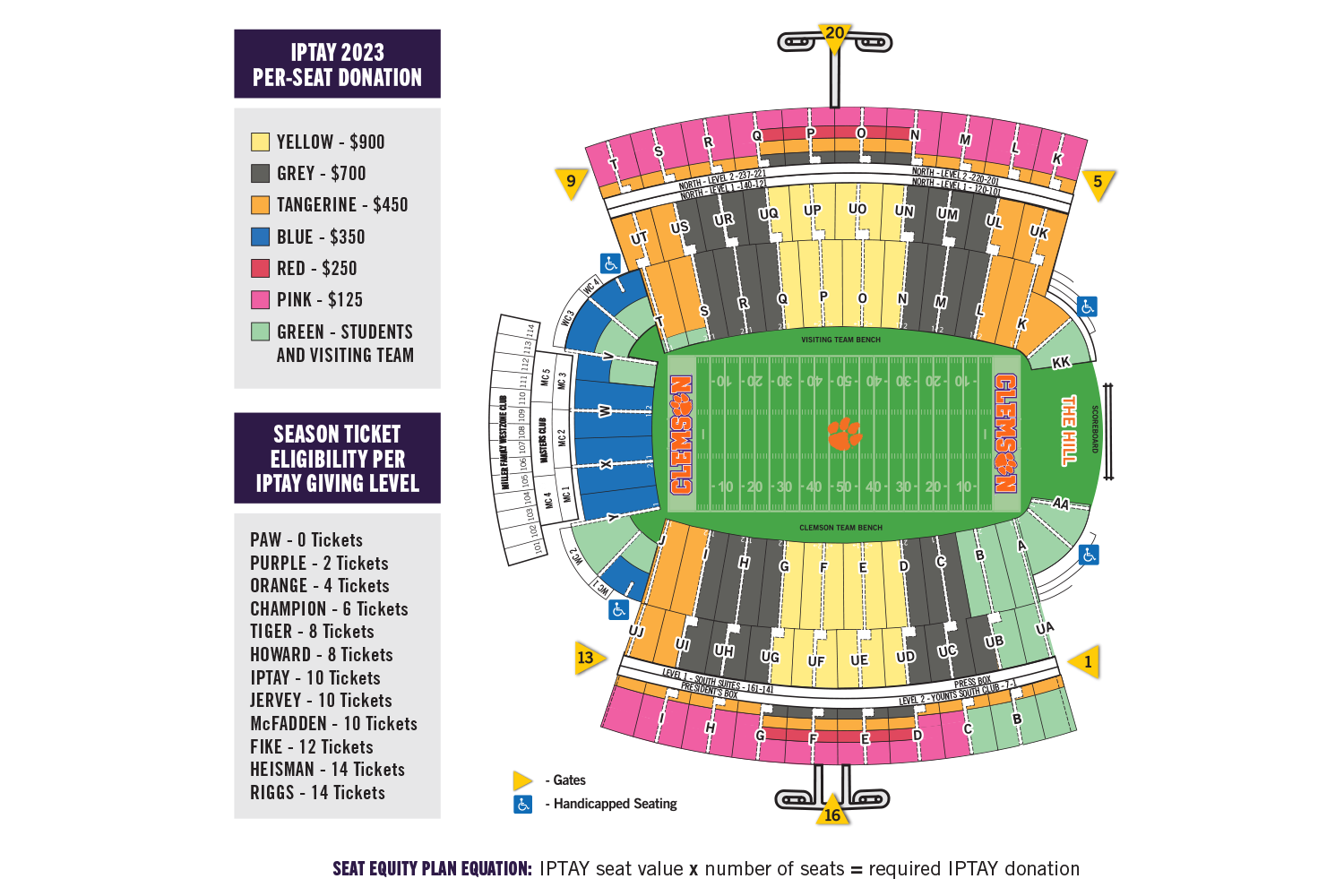

Iptay Seat Equity

Calculator And Estimator For 2023 Returns W 4 During 2022

Eligibility Income Guidelines Georgia Department Of Public Health